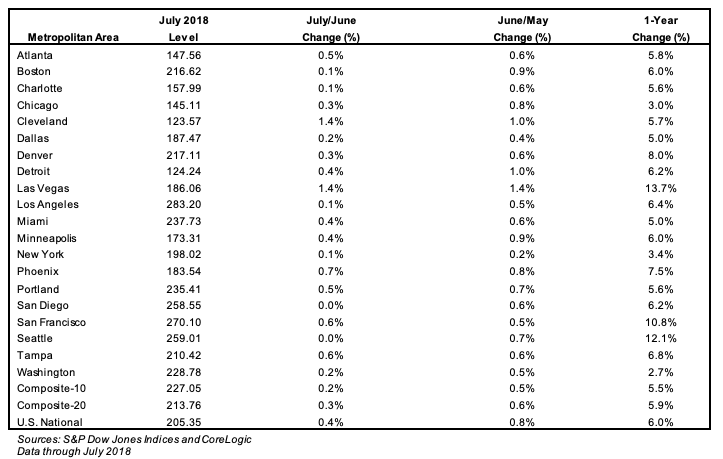

Home price growth slows to 6% in July

The rapid appreciation seen across the country in the past few years is no more, according to the latest Case-Shiller report numbers…

Annual home price growth was 6 percent in July, according to the latest S&P CoreLogic Case-Shiller National Home Price NSA Index, released Tuesday. While that would seem to bode well for homeowners, annual appreciation actually was higher the month before, at 6.2 percent. That means price growth is indeed slowing, as observed yesterday by Redfin.

S&P Dow Jones Indices Managing Editor and Chairman of the Index Committee, David M. Blitzer says the slowdown can be seen across the country, as sales of single-family homes have dwindled over the past year. Despite a gain in housing starts, housing affordability has continued to decline, he said.

“Rising home prices are beginning to catch up with housing,” said Blitzer in a prepared statement. “Year-over-year gains and monthly seasonally adjusted increases both slowed in July for the S&P Corelogic Case-Shiller National Index and the 10 and 20-City Composite indices.”

“The slowing is widespread: 15 of 20 cities saw smaller monthly increases in July 2018 than in July 2017,” he added. “Sales of existing single-family homes have dropped each month for the last six months and are now at the level of July 2016.”

Regionally, Las Vegas, Seattle, and San Francisco reported the highest year-over-year gains among the 20 cities tracked by the index. Las Vegas saw a 13.7 percent gain, Seattle saw a 12.1 percent increase and San Francisco saw a 10.8 percent increase.

“Since home prices bottomed in 2012, 12 of the 20 cities tracked by the S&P Corelogic Case-Shiller indices have reached new highs before adjusting for inflation,” Blitzer concluded. “The eight that remain underwater include the four cities which led the home price boom: Las Vegas, Miami, Phoenix and Tampa. ”

“All are enjoying rising prices, especially Las Vegas which currently has the largest year-over-year increases of all 20 cities,” he said. “The other cities where prices are still not over their earlier peaks are Washington DC, Chicago, New York and Atlanta.”

About the Index

The S&P/Case-Shiller U.S. National Home Price Index is a composite of single-family home price indices that is calculated every month; the indices for the nine U.S. Census divisions are calculated using estimates of the aggregate value of single-family housing stock for the time period in question.

The nine divisions are:

- New England

- Middle Atlantic

- East North Central

- West North Central

- South Atlantic

- East South Central

- West South Central

- Mountain

- Pacific

CoreLogic serves as the calculation agent for the S&P/Case-Shiller U.S. National Home Price Index.

For more Info on this article, visit: Inman.com

JOIN US! FREE SEMINAR: PROPOSITIONS 60 AND 90

Join us for a free informative discussion Wednesday November 7th from 6:00 p.m. – 7:30 p.m. at the Newport Coast Community Center. Tim Lappen, a noted Real Estate and family office Attorney, will be leading a roundtable discussion on the tax implications when you sell your home, and the benefits of PROPOSITIONS 60 AND 90 RSVP by November 5th to Allie@CanadayGroup.com !

Don’t wait for another downturn: recession-proof your business today

Tom Ferry’s tips to dominate – even in a changing marketplace

At our recent Success Summit, I spoke to 6,000 agents about the impending market shift coming to our industry. No one is forecasting a devastating, 2007-2009-type recession, but make no mistake: we’re due for a downturn and a return to a “new normal” market devoid of the incredible demand and appreciation we’ve witnessed lately.

“Bravo!” to those who’ve made it through the last recession. But, for those with less than 10 years in the industry, you’ve never witnessed anything like it. Behold — this type of paradigm shift will require all of us to adjust our mindset and tactics. With that in mind, here are five ways agents can continue to dominate in a changing marketplace over the next 18-24 months.

Ask yourself this important question

Are you a hobbyist, or are you running your own business?

Let’s face it, the majority of people who have a real estate license are hobbyists. They don’t treat their trade as a business. They don’t know their numbers. They’re not concerned with innovation and marketing.

But as we enter a changing economy, being a hobbyist simply won’t work. These agents will not survive.

If you’re reading this, there’s a good chance you do treat your trade like a business. Now is the time to make that commitment even stronger, ditch any of your “hobbyist” tendencies and shift your strategy to run your business by design.

Diversify your lead generation strategy

Let me tip you off about something: no one outside of your immediate family cares if you put in a half-baked effort to generate leads. People will simply find another agent to help them sell their house.

They don’t need you. But if you want to survive in a changing market, you need them. And that means doing a better job of marketing yourself.

It means operating from a marketing strategy and putting as many proverbial “lines in the water” as possible to attract buyers and sellers in your marketplace.

The very best agents have four to six diversified lead sources. Download 9 Ways to Win Every Listing in our free List & Win bundle, so you can succeed when the market shifts.

Commit to using a CRM

The best agents I know practically live inside their CRM.

Yet our research shows 64% of agents have absolutely no contact relationship management (CRM) solution.

News flash: Gmail is not a CRM!

You need an organized way to keep in contact with people. You need those people segmented into buckets. You need a systematized approach that dictates the frequency with which you’ll contact them.

Never forget the consumer has many choices.

If you’re not staying in communication and delivering value relentlessly, your days are numbered.

For more info on this article, visit: inman.com

TV Tips | It’s Not Downsizing, It’s Right Sizing

PLEASE WATCH OUR EXPANDED TV PROGRAM “RE/MAX Fines Homes, CANADAY GROUP Real Estate SHOW“ EVERY SATURDAY AT 9:00 am ON KDOC TV WITH OVER 17 MILLION VIEWERS IN ALL OF LOS ANGELES AND ORANGE COUNTIES plus San Bernardino, Riverside, San Diego and Ventura Counties. 🙂

What You Need to Know About Buying a Home in Spring 2018

Starter-home hunting? Here’s how to find an affordable one in a challenging market.

Smart choices can help homebuyers in this spring’s tight housing market.

Springtime means warmer temps, blooming flowers—and real estate season. But the market is different from year to year, and spring 2018 is a uniquely challenging one for buyers, especially those looking for starter homes. This is due to several factors: low inventory, higher prices, and rising interest rates.

“The spring market so far this year is crazy busy!” says Kelly Deschamp, an Illinois real estate agent. So what’s your strategy going to be for buying a home this spring? Here’s what you need to know to decide.

The price of starter homes is going up the most.

If you’re looking for a starter home this spring, adjust your expectations. With high demand and plenty of competition, prices are rising for starter homes to the tune of 9.6 percent more this spring than last year. Trade-up and premium homes are also more expensive this year—7.5 percent and 5.2 percent more, respectively. If you’re looking for a starter home, consider older or smaller options. Even better, look for a fixer-upper. There are 8.3 percent more fixer-upper starter homes than there were six years ago. That’s good news for anyone willing to put a little elbow grease into their investment.

Affordability is on the rise.

Don’t get too bummed about rising prices. Compared to historical housing costs, homes today are actually more affordable than they were in past decades.

Why? Two words: mortgage rates. To take out a mortgage loan in the 1980s, you’d likely pay up to 16 percent in interest—compare that with today’s mortgage rates of around 4.5 percent. For a $200,000 loan, at 4.5 percent interest, you’d pay $1,013 a month (before taxes, insurance, and other fees), but with 16 percent interest, you’d pay $2,690.

Finding the right neighborhood matters.

Trulia research found that homeownership is dropping in some neighborhoods and remaining steady in others, even within the same city. Many home buyers prefer neighborhoods full of homeowners, so figuring out the character of an area is essential. Here’s a tip: Hot spots for homeownership share one attribute—increased household incomes. Research neighborhood demographics to pinpoint median incomes and homeownership rates.

Plus, you can find out if a neighborhood is right for you with the Trulia’s new What Locals Say feature. It reveals what neighborhoods are really like, powered by the people who know them best—the locals who live there.

Spring 2018 Homebuyer Tips

-

Arrange your financing.

If you wait until after you’ve found a home to start the mortgage pre-approval process, you might lose the home in this market to someone who already has their financing ducks in a row. “You must get your loan squared away and be ready to close in 15 to 21 days, max,” says mortgage adviser Jason Fox.

-

Act fast.

To be successful and not make a rash decision, be as prepared as possible before you start looking by knowing the type of home and neighborhood you desire.

-

Put down a decent amount of earnest money.

The more earnest money you contribute, the more serious you look to the seller. “So on a $400,000 purchase, be ready to put up $7,500 to $10,000,” says Fox.

-

Be prepared for bidding wars.

In hot markets, buyers should be prepared for bidding wars. Fortunately, bidding wars aren’t always just about money. A shorter closing, willingness to rent the house back to the seller, a super-quick inspection period, and offer letters can help make a lower offer the best offer.

Fore more information about this article, visit: Trulia Blog

RE/MAX Fine Homes TV show: Episode 2/24/2018

PLEASE WATCH OUR EXPANDED TV PROGRAM “RE/MAX Fines Homes, CANADAY GROUP Real Estate SHOW“ EVERY SATURDAY AT 9:00 am ON KDOC TV WITH OVER 17 MILLION VIEWERS IN ALL OF LOS ANGELES AND ORANGE COUNTIES plus San Bernardino, Riverside, San Diego and Ventura Counties. 🙂

This Is The Best City in California To Live

24/7 Wall Street ranked the best city for living in each state. See what California city made the list.

Mission Viejo is the best city in California to live, according to new rankings. A list compiled by 24/7 Wall Street notes that Mission Viejo is one of the more expensive places in the United States when it comes to goods and services — which are “on average 29.3% more expensive than they are nationwide.” But while Mission Viejo has a high cost of living, it’s the most livable city in the state and one of the most livable cities in the country—not least of all because it’s safe.

“Area residents are largely untouched by crime,” 24/7 Wall Street writes. “There were 78 violent crimes in the city for every 100,000 residents in 2016, far fewer than the 386 incidents per 100,000 Americans nationwide.”

The median home value in the state is $667,100 and the poverty rate is 4.7 percent.

Through its analysis, 24/7 Wall Street found that the majority of cities that made the list are home to a large share of college-educated adults than the share of college-educated adults nationwide (31.3 percent). Educated populations, 24/7 Wall Street writes, are more resilient to economic downturns.

Another trend noted by 24/7 Wall Street is that the violent crime rate for almost every city on the list is lower than the U.S. rate. The presence of cultural amenities and entertainment venues was another common factor for the cities.

To determine the best city to live in every state, 24/7 Wall Street considered the 550 cities with populations of 65,000 or more. If a state had no cities with a population of at least 65,000, all cities in the state with a population of 40,000 or more were considered.

Data was collected in nine categories:

- Crime

- Demography

- Economy

- Education

- Environment

- Health

- Housing

- Infrastructure

- Leisure

24/7 Wall Street used data from Census Bureau’s 2016 American Community Service, the FBI’s 2016 Uniform Crime Report, the Bureau of Labor Statistics and ATTOM Data Solutions. For each category, specific measures contributed to a city’s overall score.

For more info, visit: Patch.com

Recent Comments